Beginner Series

How to Start Micro-Investing in Australia With Crypto

Wish investing could be easier? Many investors believe it can be with micro-investing. In this beginner’s guide to micro-investing, we cover what it is, who it's good for and how you can get started — joining over a million Aussies in the movement.

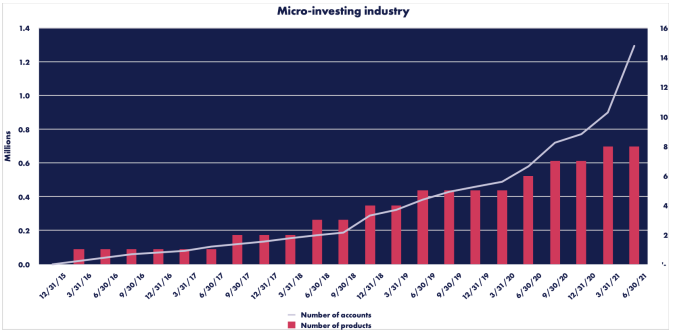

More and more Australians are using micro-investing as a way to build their portfolio and grow their wealth. Over the past year, the number of micro-investing accounts in Australia grew to over a million. That’s more than the number of people invested in ETFs listed on the Australian Stock Exchange (ASX).

Clearly, micro-investing is making an impact in Australia. Let’s explore the details to help you determine whether micro-investing is right for you.

Contents

- What is micro-investing?

- How does micro-investing work?

- Who is micro-investing good for?

- How many Australians are micro-investing?

- What are some popular micro-investing apps and platforms in Australia?

- How can you start micro-investing with crypto?

Get started right now

What is micro-investing?

Micro-investing is when you invest a small amount of money at regular intervals, such as $10 a week. You can invest in stocks with an app like Raiz or in crypto with an exchange like Cointree. Over time, these micro-investments can add up. Many investors consider it an easy way to begin growing your wealth for the future.

How does micro-investing work?

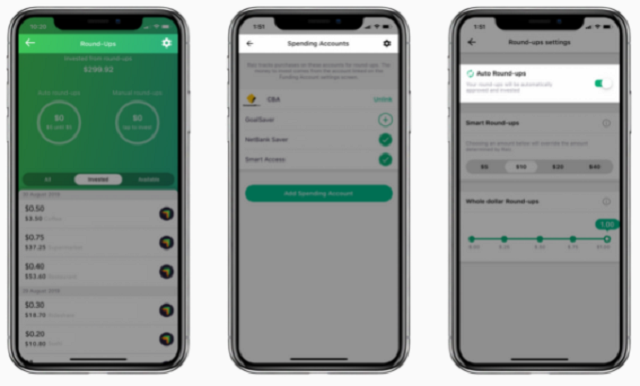

The best thing about micro-investing is you can set it up to happen automatically. With an app or exchange, you can decide on a micro-investing strategy and set the app to automatically make your micro-investments for you. You can choose to buy a range of investments, including stocks, ETFs, or crypto. For example, on Cointree you could create a recurring buy to purchase $20 of bitcoin every week.

Who is micro-investing good for?

Many people see micro-investing as a great way for beginners and young investors to start building a portfolio and growing their wealth. They see it gets their foot in the door and gives them a platform to build on. Although, other types of investors are increasingly entering the space.

Micro-investing is considered a great tool by many investors. Beginner investors love how easy it is, people with regular jobs value the automated purchases as they can automatically invest part of their paycheck, and even serious investors with a dollar-cost averaging investment strategy take advantage of the tool.

It’s also seen to be great for people who feel like they’re starting with a small capital base, as it gets them moving in the right direction and building their assets immediately.

How many Australians are micro-investing?

As you can see in the chart above from Cache, the number of new micro-investing accounts grew by over 100% in the past year. The number of micro-investing accounts reached 1.29 million, which is more than the number of investors that hold ASX-listed ETFs. It seems that many Australians believe it’s a great way to enter the market and start growing your portfolio.

What are some popular micro-investing apps and platforms in Australia?

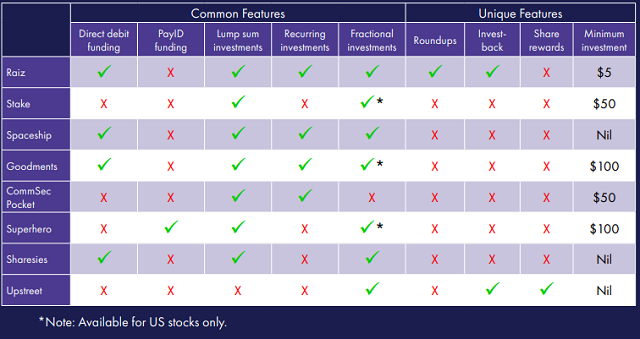

A micro-investing platform is an app, website or exchange that lets you make regular investments with small sums of money. Some of the most popular platforms are featured in the chart below, including Raiz, Stake, Spaceship, CommSec Pocket, Superhero, and Sharesies.

Raiz was the first micro-investing app to launch in Australia and has become one of the most popular. As you can see on the chart above, they offer more features than their direct competitors. Their beginner-friendly app makes them a good place to get started.

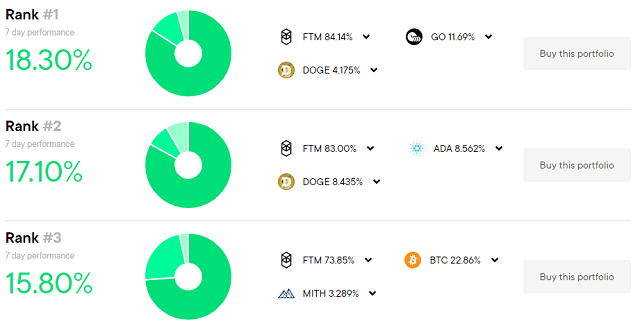

Another great platform for micro-investing is an Australian crypto exchange like Cointree. Instead of making small purchases in stocks, you can purchase cryptocurrency instead.

How can you start micro-investing into cryptocurrencies?

You can start micro-investing into cryptocurrencies on Cointree in minutes, it's that easy. With our Recurring Buy feature, you can make micro-investments every day, week or month. And you select the exact cryptocurrencies you want to invest in, such as bitcoin and ethereum.

How to set up Recurring Buys on Cointree?

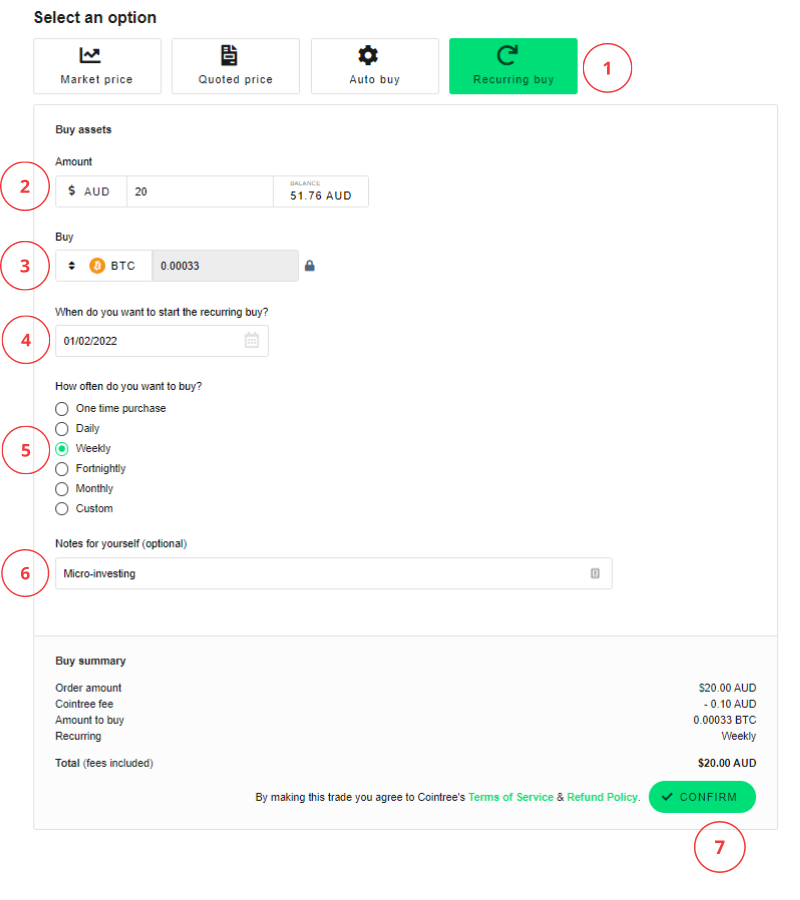

It’s easy to start making Recurring Buys on Cointree. With the feature built directly into our platform, you can select the Recurring Buy option on our Buy page and set it up in minutes. It’s the easiest way to start micro-investing in cryptocurrency.

All you have to do to set up a recurring buy on Cointree is:

- Select the Recurring Buy option on the Buy Coin page.

- Enter the AUD amount you'd like to purchase.

- Choose the cryptocurrency to purchase.

- Pick the date to start making your Recurring Buys.

- Select the frequency of your purchase, which can be daily, weekly, fortnightly, monthly, or a custom period.

- Add a note to yourself (this step is optional).

- Confirm your Recurring Buy automated order.

Now, the Cointree platform automatically makes Recurring Buys on your behalf, without you having to do anything.

The best thing about micro-investing on Cointree is you can set up to do exactly what you want. You can select the frequency, amount and specific cryptocurrency, and then automatically make investments and watch your portfolio grow.

Start micro-investing

Disclaimer\ Information provided is for educational purposes and does not constitute financial advice or investment strategy. You should obtain independent advice from an Australian financial services licensee before making any financial decisions.