Intermediate Series

Cryptocurrency in Australia: 7 Key Charts & Statistics

In this article on cryptocurrency in Australia, we explore the key Australian cryptocurrency statistics and charts; you can see which coins other Australians are hodling, where they store their coins, and their long-term predictions. Let’s start with seven key crypto statistics.

7 key takeaways - Crypto statistics Australia

Is Australia a leader of cryptocurrency growth and adoption? Looking at these statistics from Statista, Finder and Capterra, it certainly seems so. Moreover, they indicate that Australians understand how the asset class performs and are focused on researching the fundamentals before investing.

- 4.6 million Australians own cryptocurrency.

- Bitcoin is Australia's most popular coin, while Dogecoin is the fourth favourite.

- The whitepaper and community engagement are the most important factors when Australians are investing in crypto.

- 60% of Australians use a hot wallet.

- Australia has the third-highest rate of crypto adoption in the world.

- More men than women own crypto in Australia, for now.

- 51% of Australians predict cryptos’ high volatility will continue.

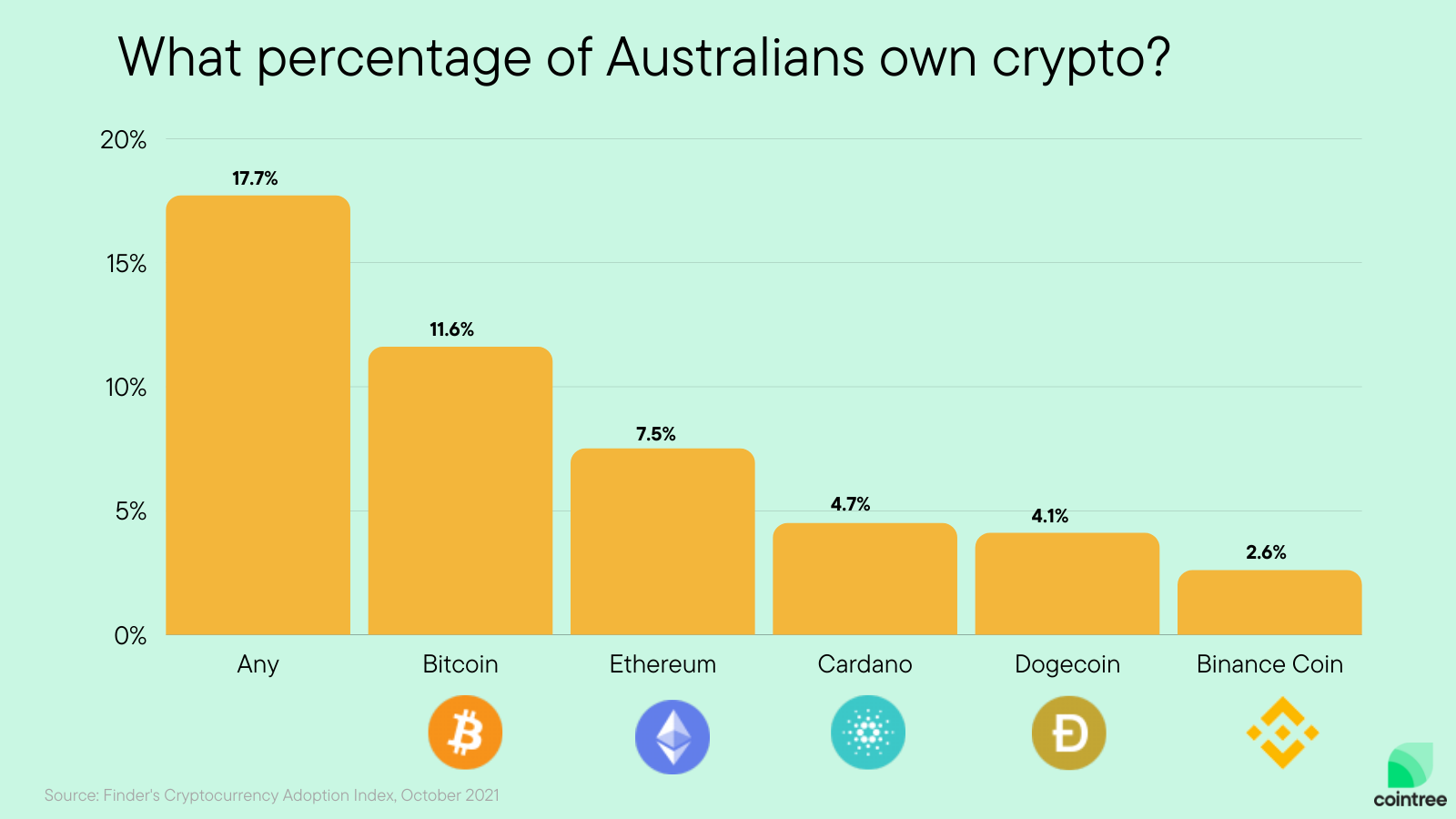

1. 4.6 million Australians own cryptocurrency

With 17.7% of Australians reporting that they own at least one cryptocurrency, an astonishing 4.6 million Aussies now own cryptocurrency. And now that regulations in Australia are becoming more welcoming of cryptocurrency, that figure looks set to rise much further.

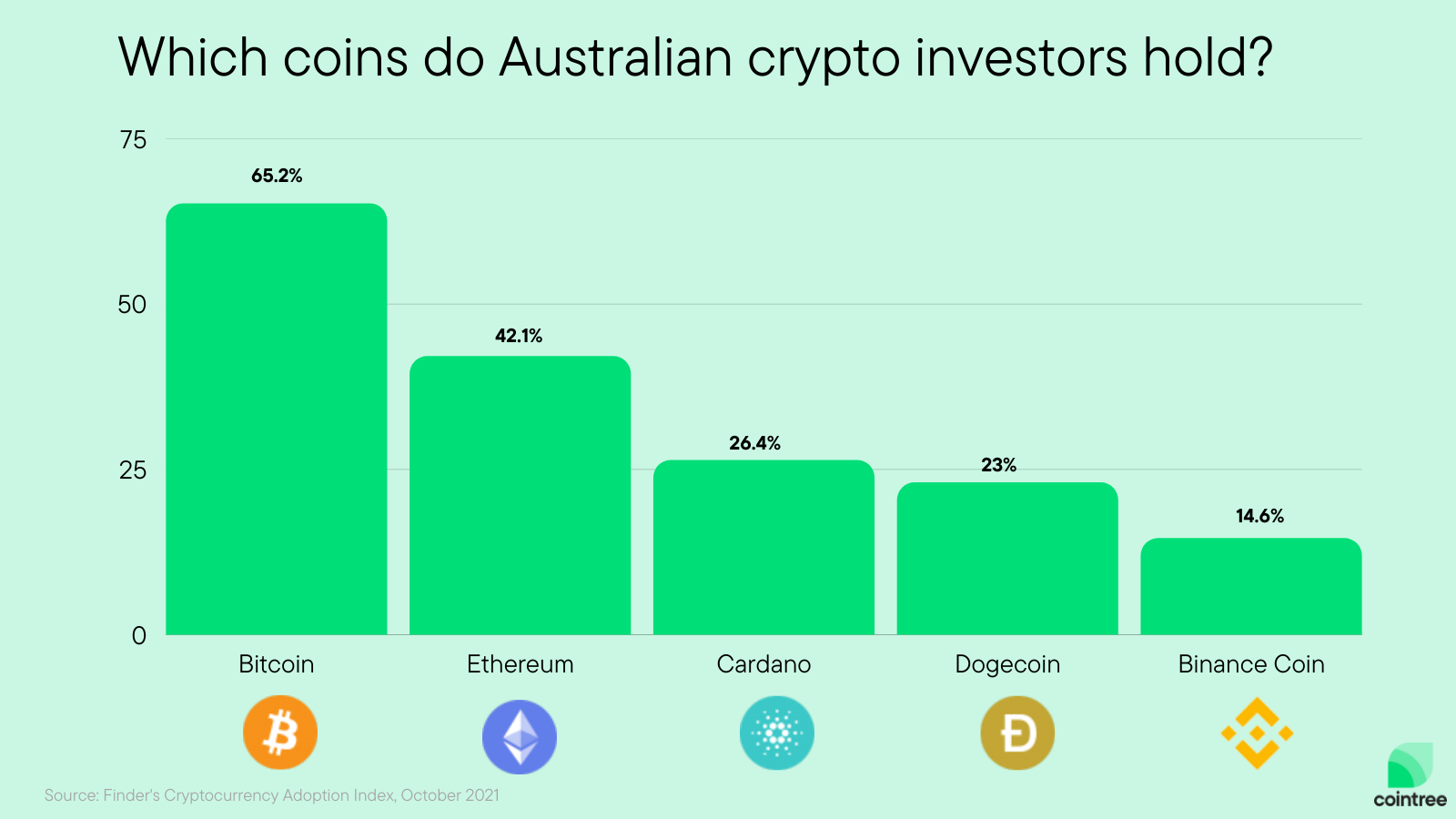

2. Bitcoin is Australia's most popular coin, while Dogecoin is the fourth favourite

It’s no surprise that Bitcoin, Ethereum and Binance Coin are the most widely held coins as they’re the three largest by market cap. However, both Cardano and Dogecoin are outside the top five, and Dogecoin is outside the top ten, indicating that while they’re widely held, it’s likely investors dedicated more of their portfolio towards bitcoin and Ethereum.

The five most popular cryptocurrencies in Australia are:

- Bitcoin (65% of crypto investors hold bitcoin)

- Ethereum (42%)

- Cardano (26%)

- Dogecoin (23%)

- Binance Coin (14.6%)

Naturally, looking at the most popular coins, the next question is; how did they perform? As of January 2022, here’s how the five most held coins performed over the past year:

- Bitcoin: +35%

- Ethereum: +235%

- Cardano: +403%

- Dogecoin: +1,602%

- Binance Coin: +1,100%

As you can see, there is a vast difference between the performance of the coins over the past twelve months. It’s important to note that much of bitcoin’s meteoric rise occurred just over a year today with the altcoins following after, helping explain some of the divergences between twelve-month returns.

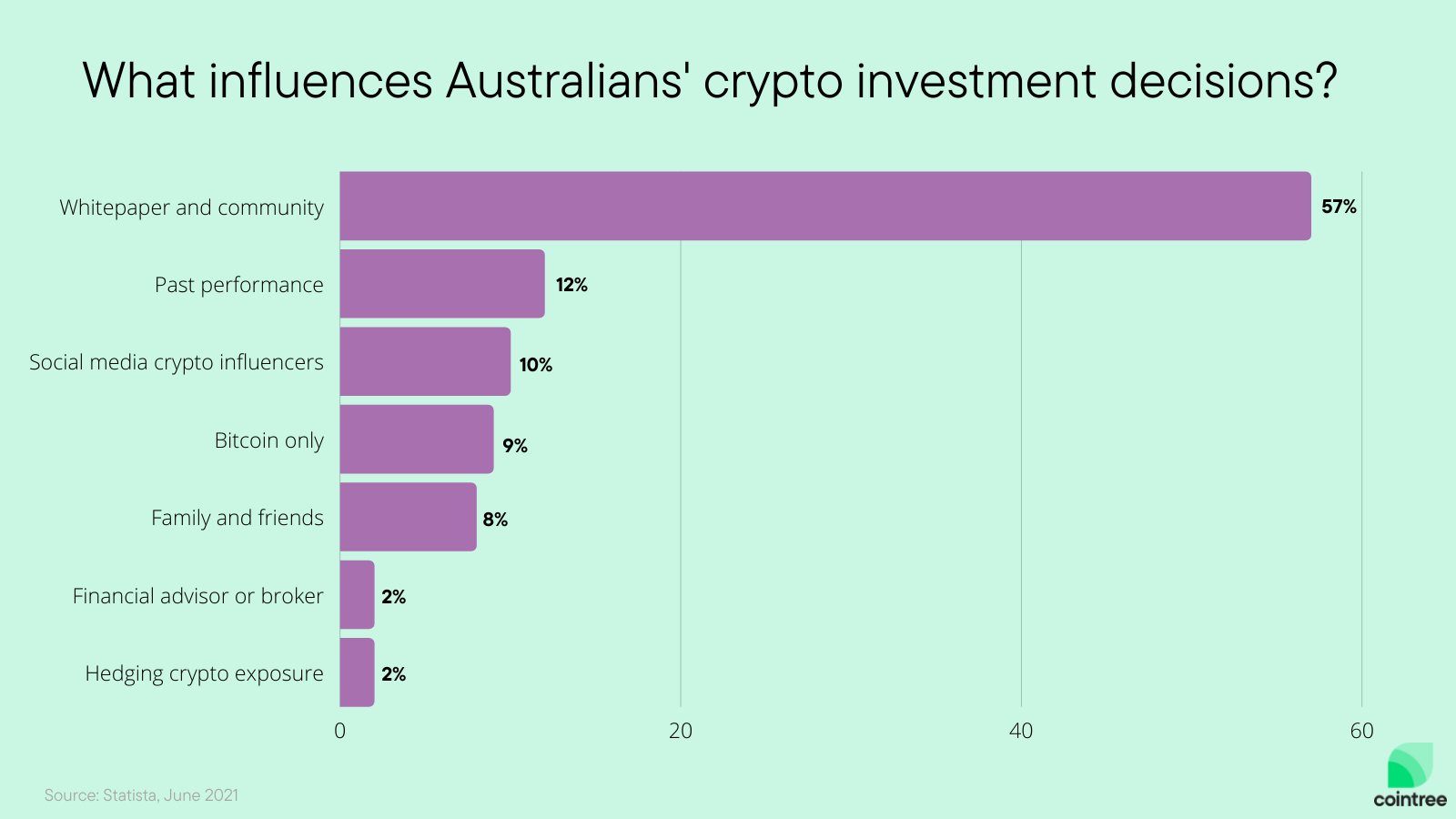

3. The whitepaper and community engagement are the most important factors when Australians are making investment decisions

It’s common in crypto for people to say ‘Do Your Own Research’ (DYOR). The graph above indicates that is exactly what Australian investors have been doing.

Social media influencers and family and friends only influence 10% and 8% of Australians when making crypto investments. Instead, 52% of Aussies are doing their research and relying on the whitepaper and community engagement to inform their investment decisions. Essentially, Aussies are looking at the facts more than they’re listening to their friends.

Overall, ranked in order, the most important factors influencing Australians crypto investments are:

- The whitepaper and community engagement.

- Past financial performance of the cryptocurrency.

- Social media crypto and financial influencers.

- Bitcoin is the only consideration within crypto.

- Family and friends recommendations and suggestions.

- Financial advisors or brokers.

- Hedging the risk of the asset class growth or decline.

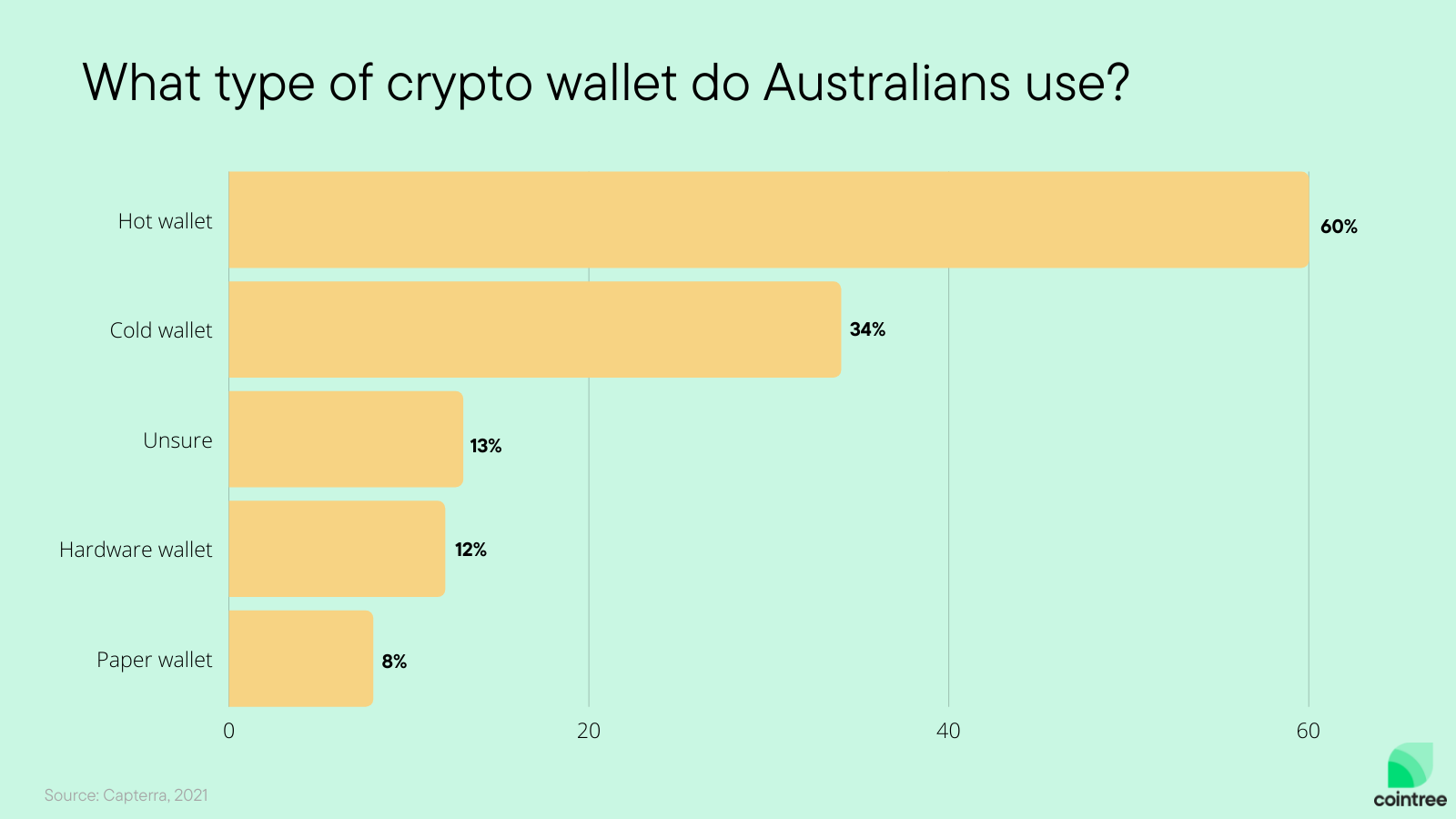

4. 60% of Australians use a hot wallet like Cointree’s free multi-coin wallet

Where’s the best place to store your crypto? For 60% of Australian crypto owners, that includes hot wallets such as the free multi-coin wallet that you get when you create an account with Cointree.

What exactly are the types of wallets highlighted in the image above? Let’s quickly go over the most common types of crypto wallets.

- Hot wallet - A hot wallet is a crypto wallet that you access online, through a cryptocurrency exchange like Cointree.

- Cold wallet - A cold wallet is stored completely offline.

- Hardware wallet - A hardware wallet is a specific type of cold wallet, such as a Ledger or Trezor. They provide all the benefits of cold wallets, while being more user friendly.

- Paper wallet - A paper wallet is another type of cold wallet, where the seed phrase is stored on a piece of paper.

For more information on crypto wallets, check out our article on the best bitcoin wallet in Australia.

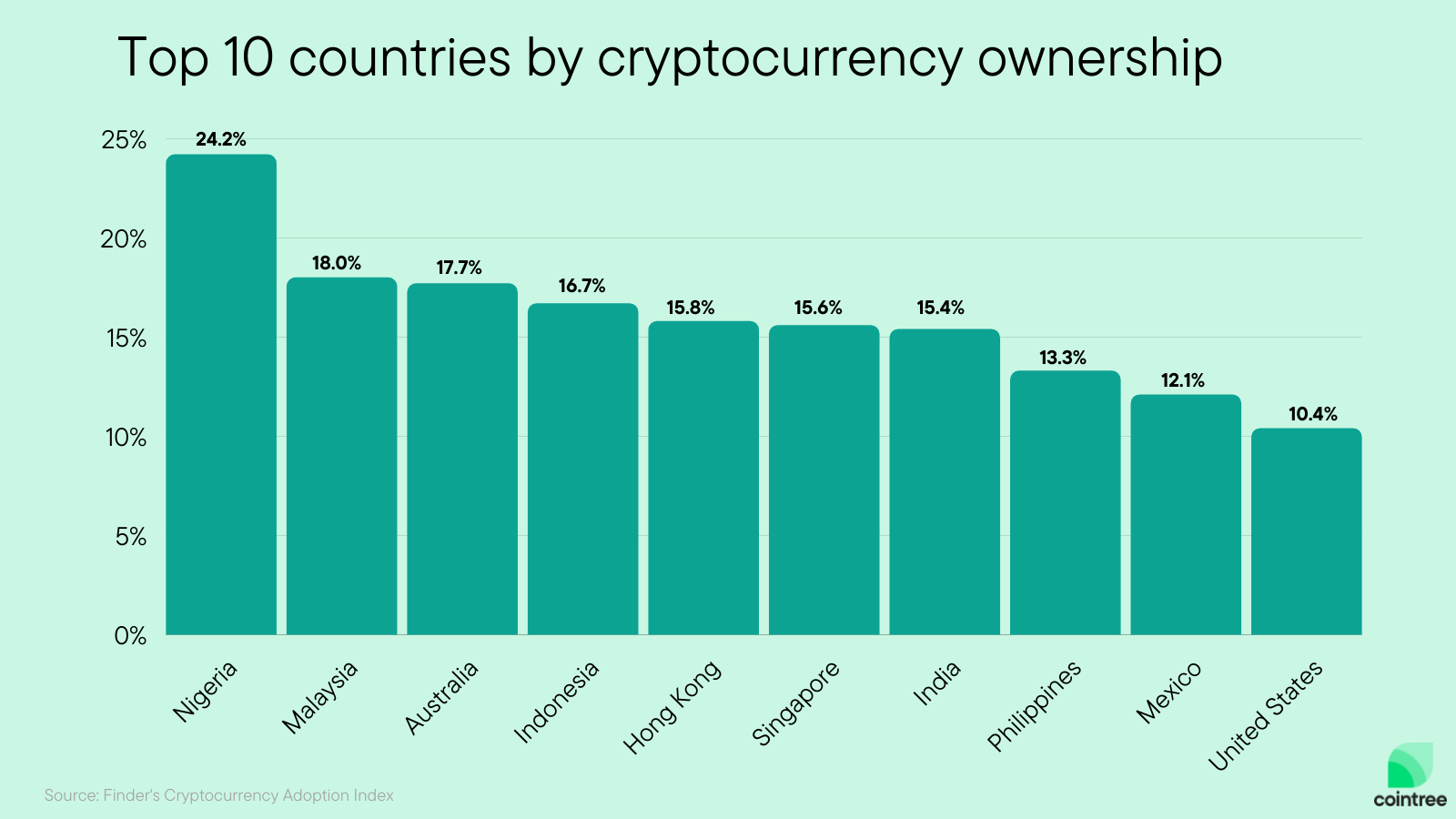

5. Australia has the third-highest rate of crypto adoption in the world

Australia has the third-highest rate of crypto adoption in the world, far ahead of the United States sitting back at number ten. Why are we so far ahead of the US? For a start, regulators have been much friendlier towards crypto innovation in Australia compared to the US.

However, the real stand out is Nigeria, with the most cryptocurrency adoption in the world. They have more than 33% more adoption than the next highest country and more than double the adoption in the US.

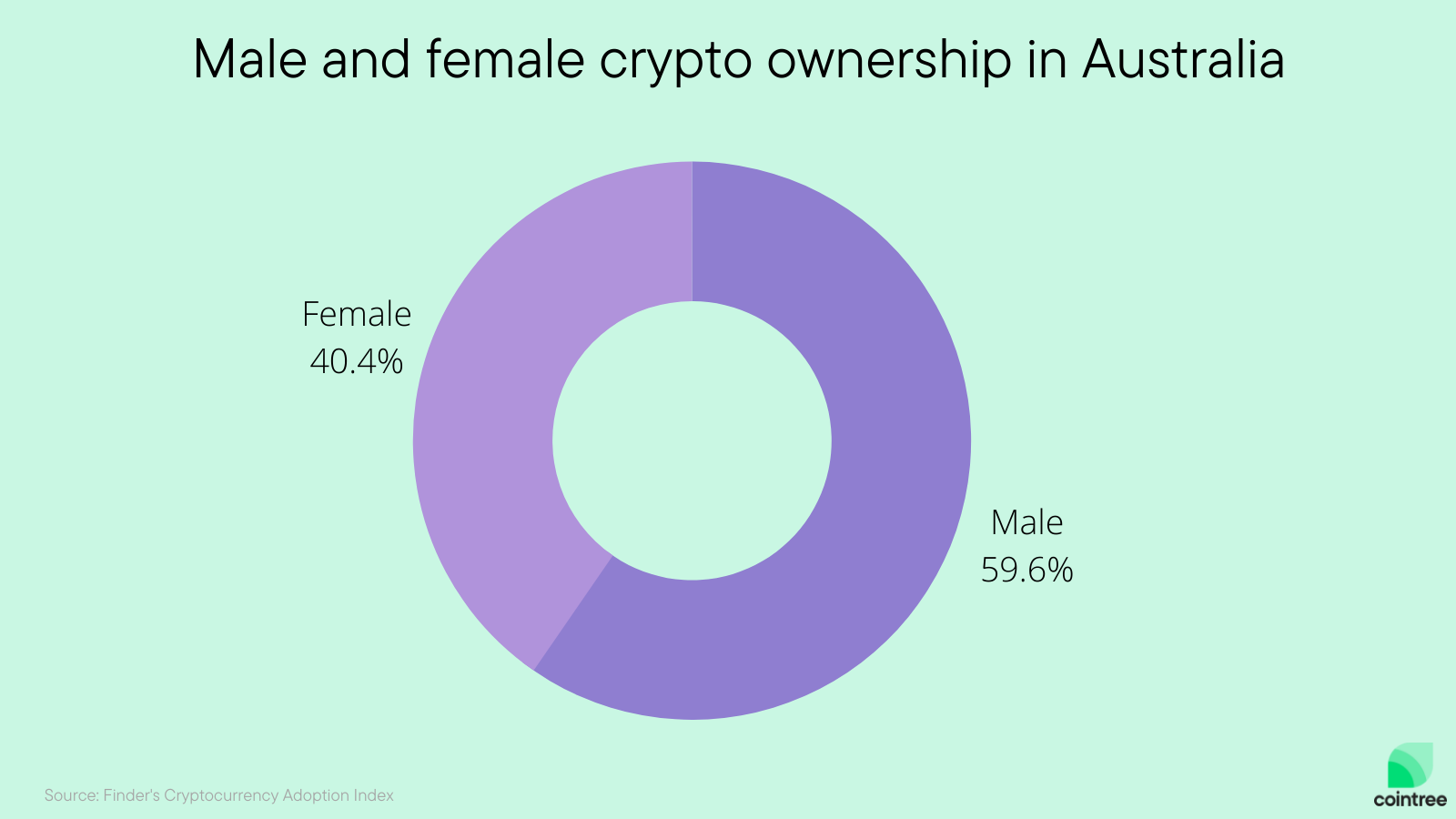

6. More men than women own crypto in Australia, for now

While men currently hold more cryptocurrency than women in Australia, this is quickly changing as more and more women enter the crypto community. In 2021, Cointelegraph reported that the number of women in crypto had more than doubled over the year. It’s an exciting time for the crypto community.

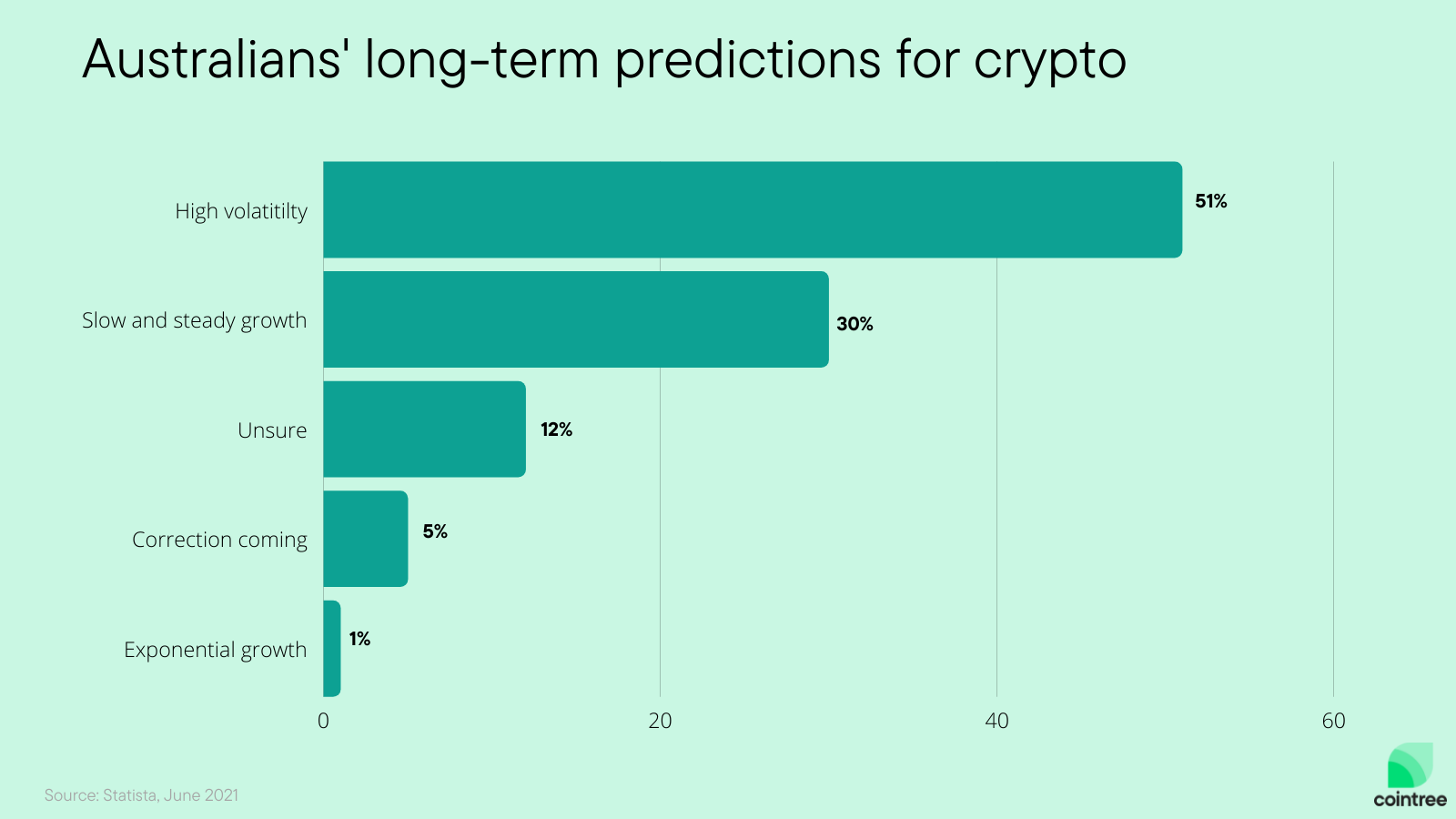

7. 50% of Australians predict cryptos high volatility will continue

What do Australians see for the future of the crypto industry? High volatility has become expected in the crypto community, and most investors no longer are surprised by sudden surges or corrections. Volatility aside, 30% of Australians see slow and steady growth while only 5% see a correction coming.

The future of cryptocurrency in Australia

Overall, looking at the cryptocurrency stats in Australia, we can see that Australia is filled with millions of savvy cryptocurrency investors. Not only do the majority recognise the inherent volatility of the asset class, they do their own research and evaluate the fundamentals before investing in a cryptocurrency. Still, while 4.6 million Australians have invested in crypto, there is plenty of growth left for cryptocurrency in Australia. In many ways, we’re still early.