The Weekly Wrap

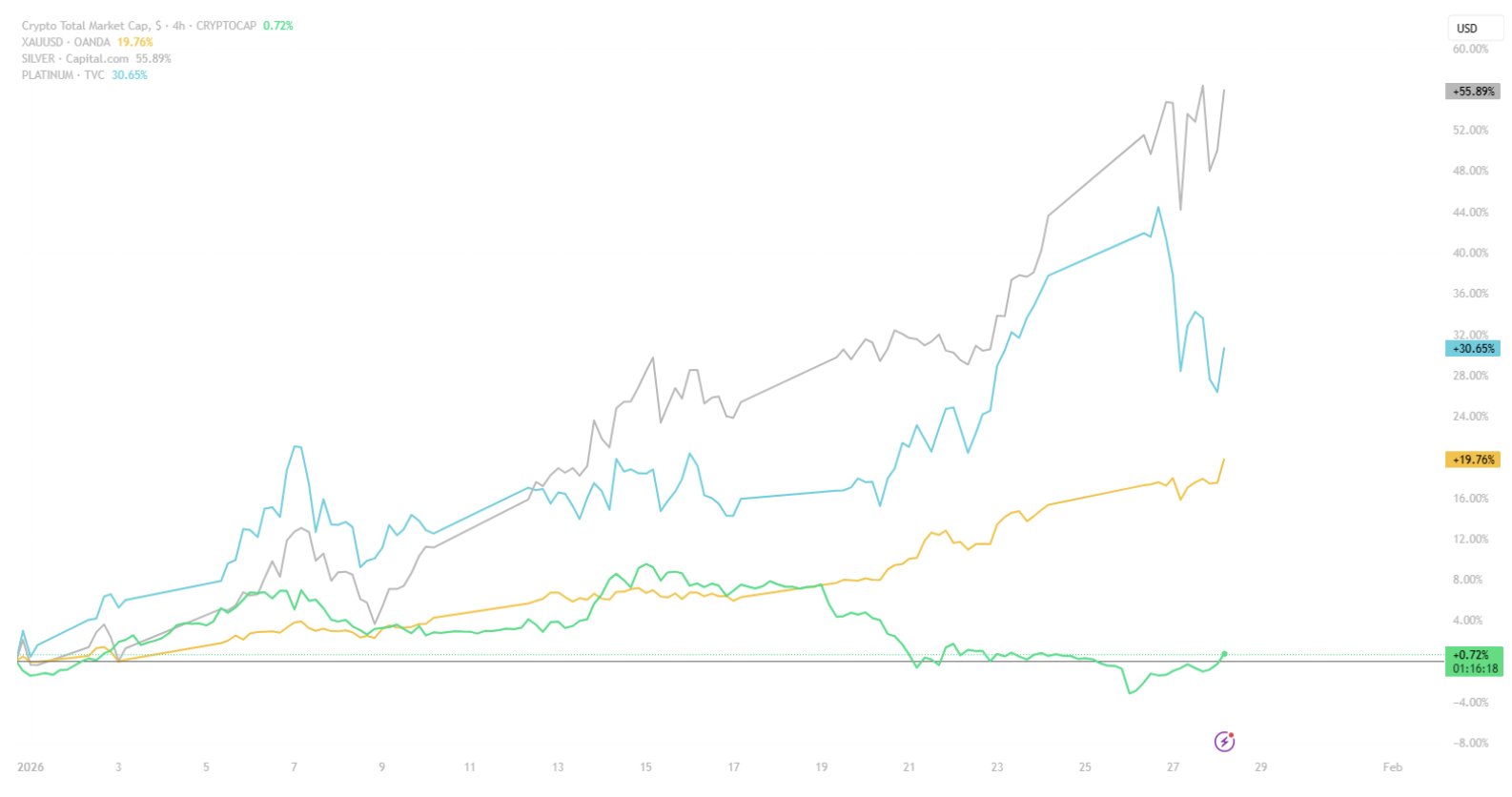

Another week, another round of crypto doing… not much. The total crypto market cap crept up just 0.68%, while commodities kept ripping, with silver quietly outperforming and making it feel like our grandparents picked the right portfolio this cycle. Since the start of 2026, Silver is up 55.9%, Platinum 30.7%, and Gold 19.8%, all comfortably outperforming crypto which is only up 0.7% YTD.

Bitcoin ETFs also cooled off after recent momentum, recording outflows every day from the 20th to the 23rd. At the same time, Bitcoin’s Fear & Greed Index is sitting at 29, firmly in the fear zone.

This is usually the part of the cycle where people say, “buy when there’s fear.”

It sounds easy in hindsight.

It rarely feels easy in real time.

For now, crypto remains stuck in consolidation, with investors watching, waiting, and second-guessing every move, while other asset classes quietly steal the spotlight.

Over the last 7 days:

- Bitcoin (BTC) down 4.36%

- Ethereum (ETH) down 3.38%

- XRP down 3.08%

- Solana (SOL) down 4.07%

Other movers:

BTC

Bitcoin stumbled this week, sliding 5% and confirming what many suspected… that breakout a few weeks back was more of a fake-out / liquidity grab than the real deal. Price quickly slipped back into range, catching late longs offside.

On the buy-the-dip front, Michael Saylor’s firm Strategy was back at it, snapping up another US$267M worth of BTC. It’s a smaller bite compared to recent monster buys of US$1.2B and US$2.1B, but still reinforces the same message: demand is showing up on weakness. BTC ETFs logged four straight days of outflows to end the week, eating into the prior week’s strong inflows.

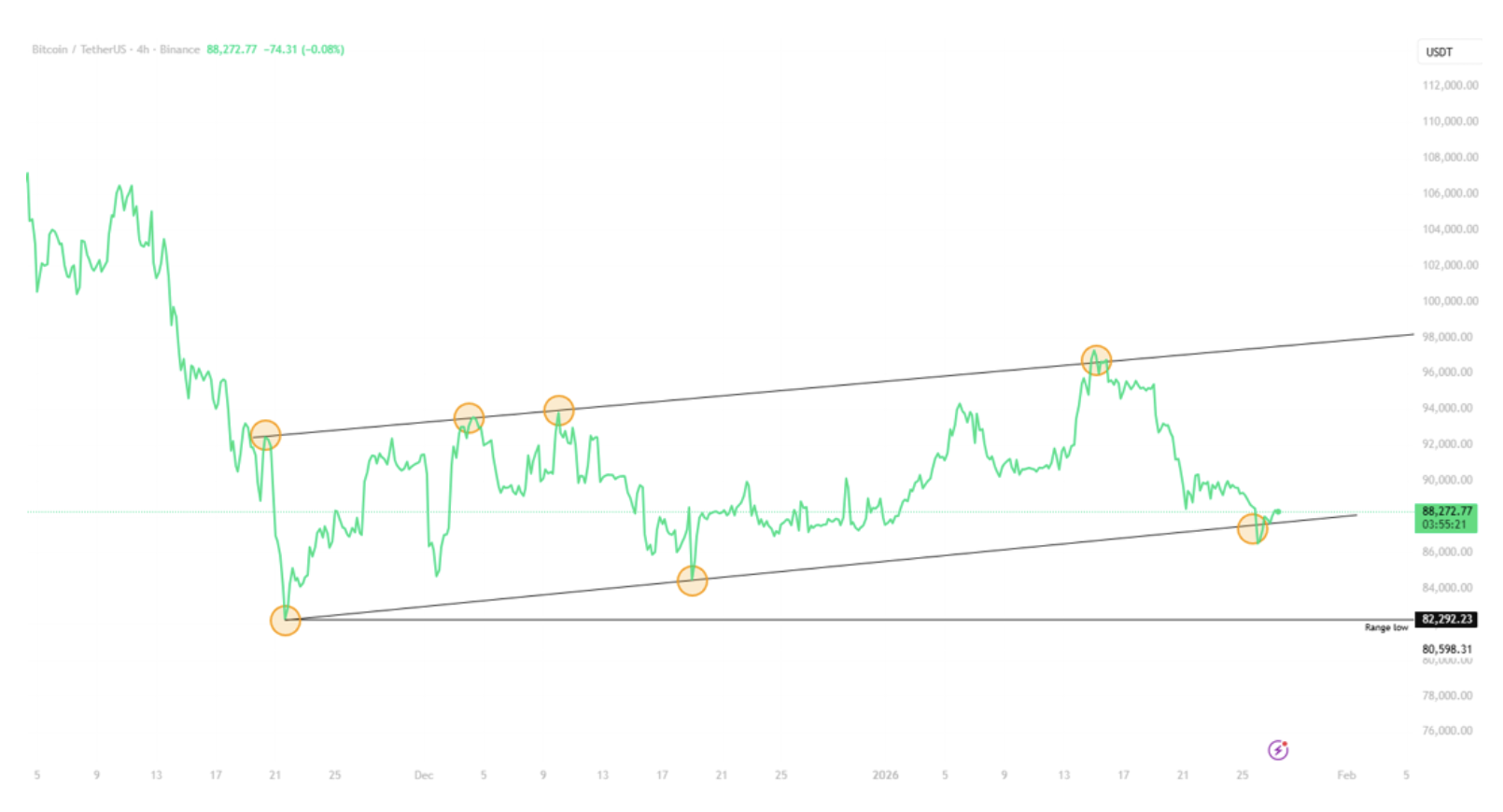

Zooming out to the chart, BTC is still grinding inside an ascending flag which is a structure that historically leans bearish. We’ve just tagged the lower end of that range. If this level holds, a bounce back toward the range highs is on the table. If it doesn’t, the market may go hunting liquidity lower, with $82k USD still the key downside level to watch (just like last week).

ETH

Another week, same story for Ethereum. Price continues to chop inside the range that’s been in place since November, with ETH down ~10% over the past seven days and drifting back toward the US$2,685 range lows.

Away from price, the Ethereum Foundation has formed a dedicated post-quantum security team, officially making quantum resistance a strategic priority. As quantum computing advances, long-term network security is becoming a bigger conversation across crypto.

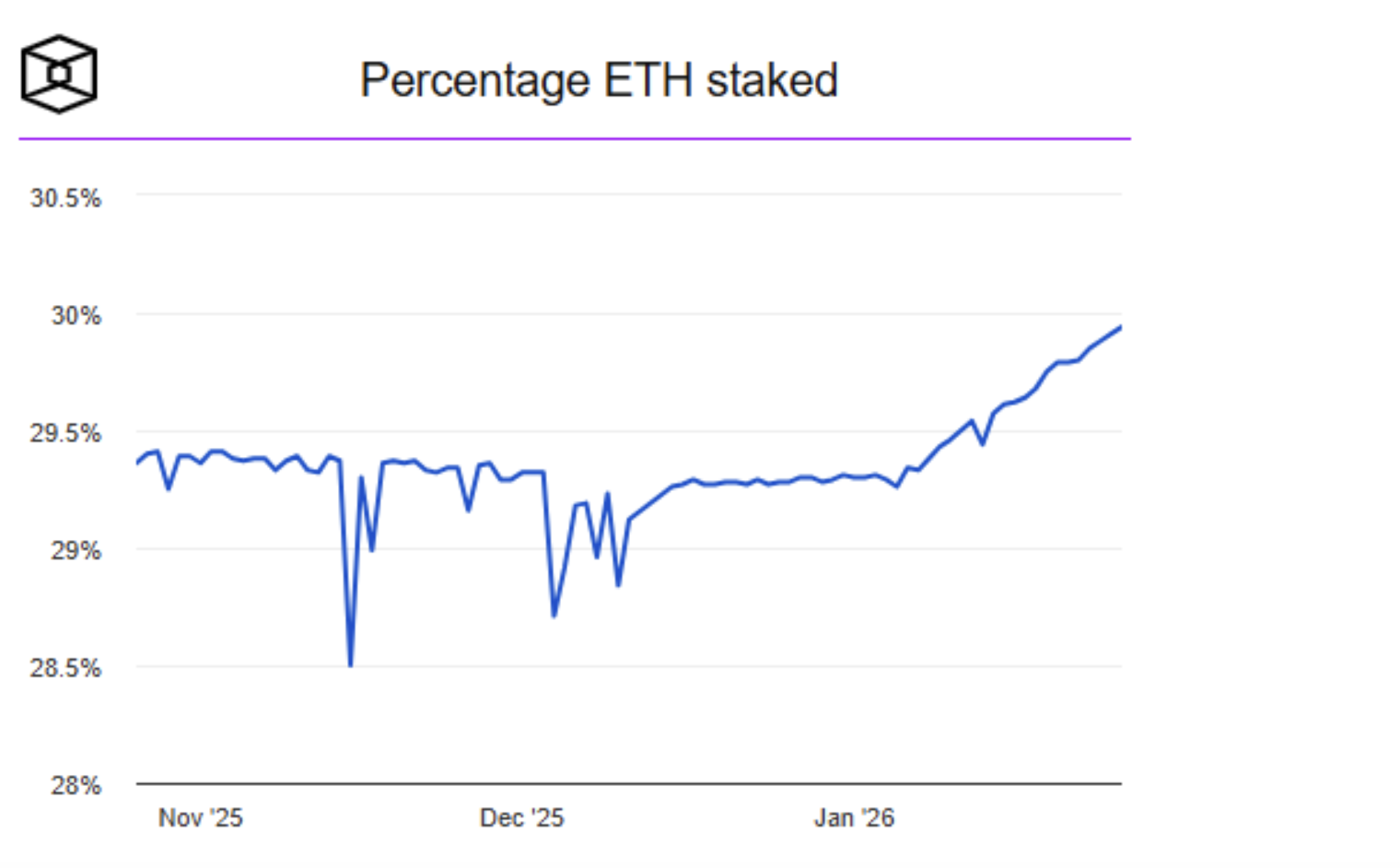

On the network side, staked ETH is nearing 30% of total supply which is an all-time high. A rising staking ratio points to more ETH being committed to securing the network and earning yield rather than remaining liquid, reducing immediate tradable supply while signalling continued participation in Ethereum’s proof-of-stake system.

ALTCOINS

SOL

This is a big one. Ondo Finance has expanded Ondo Global Markets to Solana, bringing 200+ tokenised U.S. stocks and ETFs onchain with Wall Street–level liquidity for the first time.

Instead of relying on thin onchain pools, Ondo taps real liquidity from exchanges like the NYSE and NASDAQ, unlocking million-dollar trades with near-zero slippage. With Solana’s 3.2M+ daily active users, this is a major step toward internet-scale capital markets and one of the strongest real-world asset use cases to land on SOL yet.

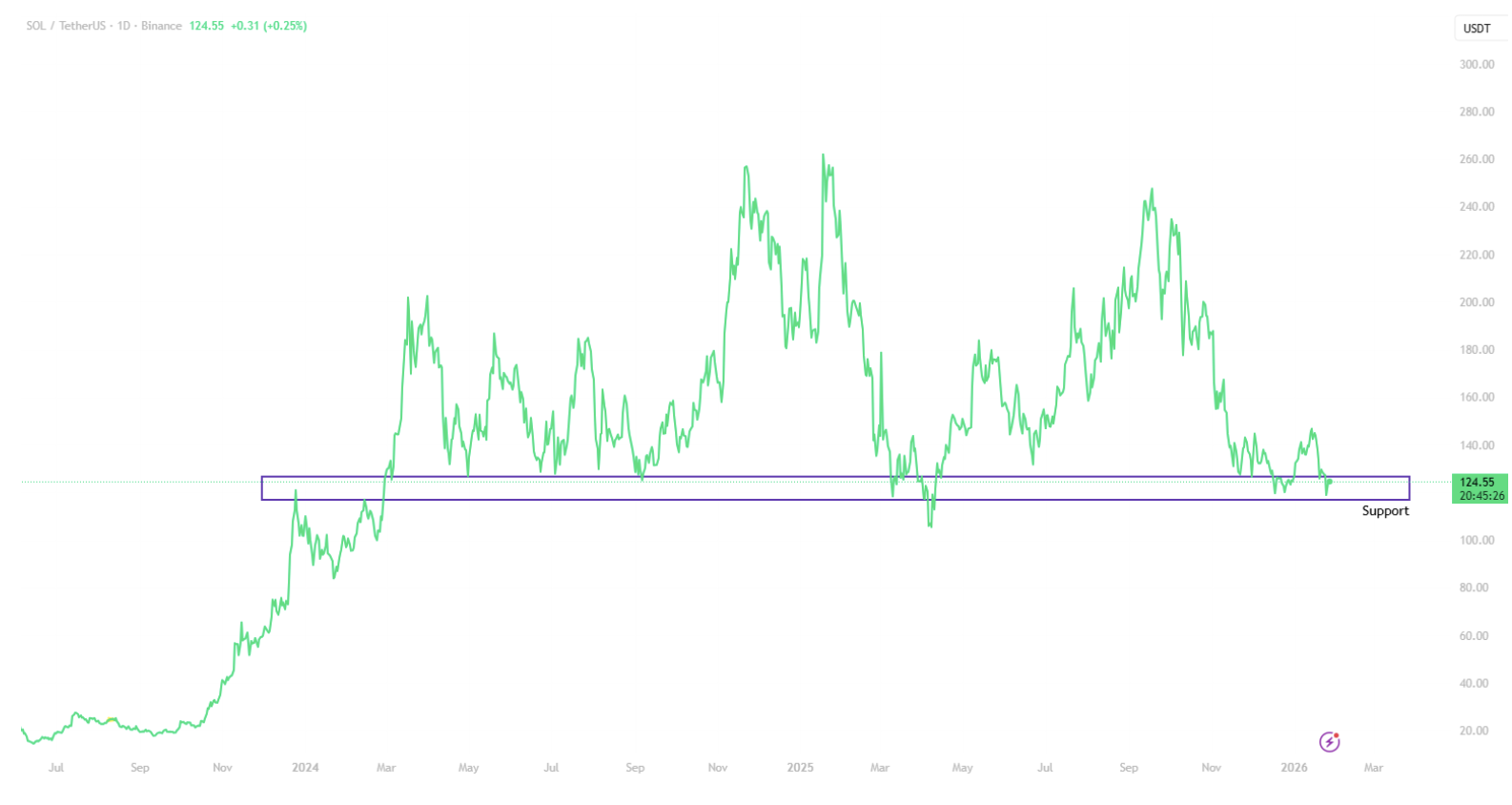

As the chart shows, SOL is holding key support around the $125 USD level, a zone that first came into play in December 2023 and has since acted as a consistent bounce area. Price is now back at this level, putting Solana at a decision point. A hold here could fuel a move higher, while a clean break below support would increase the risk of a broader bearish move.

ALGO

Algorand is a high-speed, low-cost Layer 1 built for payments, tokenisation, and stablecoin rails using a pure proof-of-stake model.

Short term, ALGO has slightly outperformed the broader market with modest weekly gains, helped by renewed ecosystem momentum. Recent updates include the launch of an Ecosystem Advisory Council and governance changes at the Algorand Foundation, signalling improved coordination and longer-term network maturity, alongside the recent USDC developments.

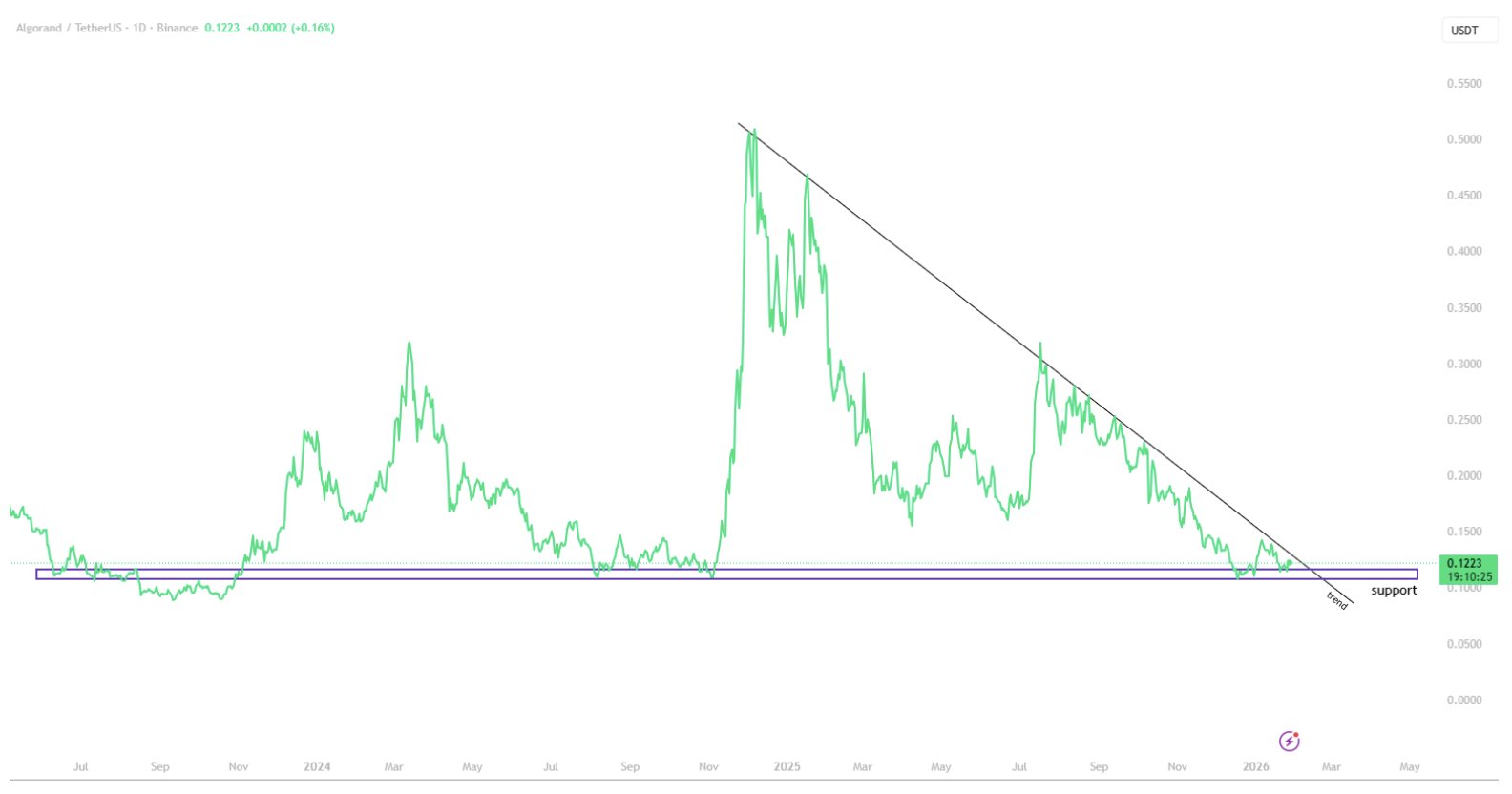

As shown on the chart, ALGO is compressing near this key level, having held above long-term support while remaining capped by shorter-term resistance. This tightening range puts Algorand at a clear decision point, where a break in either direction is likely to set the next move. The 1hr RSI has flashed overbought so we could see a small retrace or consolidation at these levels.

GOLD

Gold just punched through $5,000/oz USD, and the flows tell an interesting story. Tether reported that its gold-backed token Tether Gold (XAUT) is now growing faster than USDT, with supply up 38% in Q4 versus USDT’s 7% growth. That translated to roughly $882M USD in tokenized gold sold in one quarter alone.

The takeaway? As inflation and debt concerns linger, demand isn’t just moving into dollars on-chain, it’s rotating into tokenized gold, blending a centuries-old store of value with crypto rails.

The commodities supercycle is still doing its thing. Since the start of 2026, silver is up 55.9%, platinum 30.7%, and gold 19.8%, all comfortably outperforming crypto. Over the same period, the total crypto market cap is up just 0.7%, highlighting how capital has been rotating into hard assets while digital assets consolidate.

BUY PAXG (GOLD)