The Weekly Wrap

Just when it looked like crypto was kicking off 2026 with some heat… the market hit pause. Bitcoin is now only up 0.86% YTD, while ETH has slipped into the red, down 0.28% on the year. Zoom out to the bigger picture and it tells the same story: the total crypto market cap is back around $2.99 trillion USD, up just 0.5% YTD. In other words, we’re pretty much right back where we started.

But under the surface, something interesting is happening.

Bitcoin ETFs just had a monster week. We saw two huge inflow days of $750 million and $840 million USD, bringing fresh capital into the market during what’s otherwise been a tight consolidation phase.

That’s sparked the obvious question traders are asking right now:

Are larger players quietly building positions while prices move sideways?

Over the last 7 days:

- Bitcoin (BTC) down 5.92%

- Ethereum (ETH) down 7.63%

- XRP down 12.05%

- Solana (SOL) down 12.33%

Other movers:

BTC

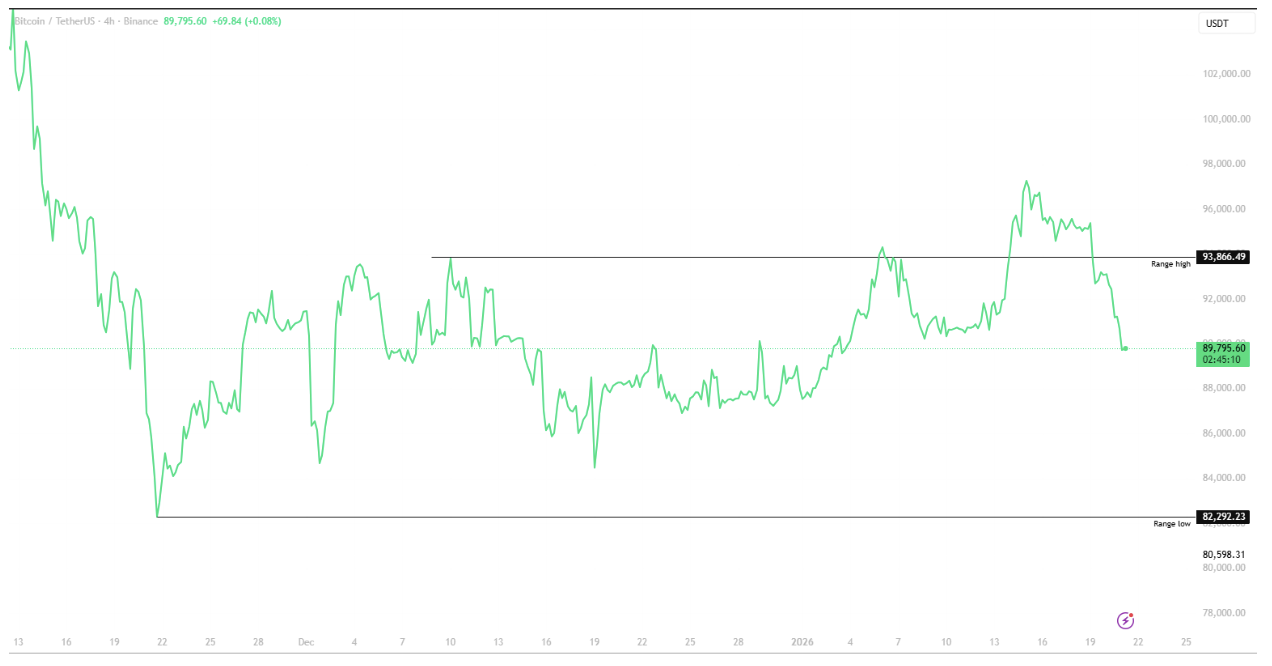

Bitcoin was cruising. Price pushed cleanly out of its range, tagged $97k USD, and spent four days consolidating above the range highs. Then macro headlines hit the tape.

Donald Trump’s comments around “tariffs” rattled risk markets, triggering a broad sell-off that dragged BTC straight back into its prior range around $89.8k USD. Adding fuel to the move, tensions between the US and Europe escalated after Greenland became part of the conversation, with the EU floating a potential “trade bazooka.” That could mean restricted access to EU markets or export controls, lifting global uncertainty.

Zooming back to the chart: BTC is back where it started, and if buyers don’t step in soon, the next area traders are watching sits lower. A failure to bounce here opens the door to a deeper pullback, with downside risk toward the low area of $82k USD

ETH

Ethereum spent the week chopping sideways.. again. Price stayed locked in the $2,600–$3,400 USD range, with a quick macro-driven wobble on Monday after tariff and Greenland headlines sparked $123M in long liquidations in just four hours.

Although price action isnt great, ETH just hit a double flex: Daily transactions hit an all-time high (roughly double this time last year) while gas fees slid to record lows. More people are using the network, paying less to do it.

That said (see chart below), the commodity market is still stealing the spotlight. Gold and silver keep printing fresh highs, leaving ETH lagging year-to-date, with silver up 29.96% versus ETH’s -0.14% YTD.

ALTCOINS

SOL

Solana’s fundamentals are flashing mixed signals. On the bullish side, momentum is real: Solana is home to 9 of the 22 fastest-growing companies to hit 100M USD in revenue, per FrictionlessVC. Meme hub Pump.fun is also popping off, doubling active addresses in a week with daily token launches nearing 31,000, according to Dune analytics.

But it’s not all green candles. Network-wide metrics like DEX volume, transactions, and app revenue have cooled recently, keeping overall activity under pressure.

LINK

Chainlink popped to a monthly high after Bitwise filed for a spot Chainlink ETF on the NYSE, putting LINK back on the institutional radar.

The move signals growing TradFi interest in oracle infrastructure, not just L1s.

TRON

MetaMask just widened its world. The once Ethereum-only wallet has added native support for the Tron network, continuing its push beyond ETH after rolling out Bitcoin and Solana support late last year.

Users can now hold and manage Tron assets directly in MetaMask, send USDT, stake TRX, and swap across Tron, EVM chains, Solana, and Bitcoin.

Tron has traded in a broad consolidation range against BTC since 2019, cycling through periods of relative strength and weakness. Price is now sitting near the top of that long-term range, with TRX pressing against resistance and positioning for a potential breakout versus Bitcoin after nearly six years of consolidation.\ \ Keep your eyes on this chart!

Stablecoins (USDT, AUDF)

Bank of America CEO Brian Moynihan warned interest-bearing stablecoins could drain up to US$6T from bank deposits, potentially hitting lending.

Crypto firms pushed back, with Brian Armstrong arguing bans on stablecoin rewards protect banks from competition rather than consumers.

Stablecoins are growing steadily. Total supply climbs from roughly $200B in early 2025 to just under $300B by early 2026, with only a small pause late in the year. Liquidity is flowing into crypto, not out.\ \ Rising stablecoin supply usually signals capital positioning and dry powder building on-chain, often ahead of higher market activity.