The Weekly Wrap

Since the New Year, the total crypto market cap has risen from A$4.32 trillion to A$4.79 trillion, an 11% increase. Daily exchange volume has slightly picked up from a 12 month low seeing more activity since the new year.

Bitcoin has remained relatively stable during this period, while some altcoin pairs have shown short-term outperformance against BTC.

These moves indicate early relative strength in parts of the altcoin market, though broader confirmation of a sustained trend has not yet emerged.

Over the last 7 days:

- Bitcoin (BTC) up 2.66%

- Ethereum (ETH) up 1.83%

- XRP down 4.85%

- Solana (SOL) up 5.09%

Other movers:

BTC

Last week, Bitcoin was pushing toward the top of its range around USD $94k. It got there… then hit the brakes. Price cooled off and slipped back into consolidation. BTC is now having another go to break this trend as we speak with a strong move.

Right now, the key level to watch is USD $94k. If BTC comes down to retest that area it will need to hold so we can get another run higher. Otherwise we are in for another deadly fakeout.

One thing worth noting: there’s still a CME gap around USD $88k, which BTC has historically liked to revisit. And if broader sentiment turns negative, a sweep of the USD $82k lows wouldn’t be out of the question.

ETH

Ethereum’s lining up fundamentals and structure.

On the news front, SharpLink Gaming revealed it has staked $170m USD worth of ETH via Linea, adding to the growing list of companies using Ethereum as a treasury and yield asset. At the same time, Morgan Stanley has added an Ethereum trust to its planned crypto ETF lineup which is another sign ETH is staying firmly on institutional radars.

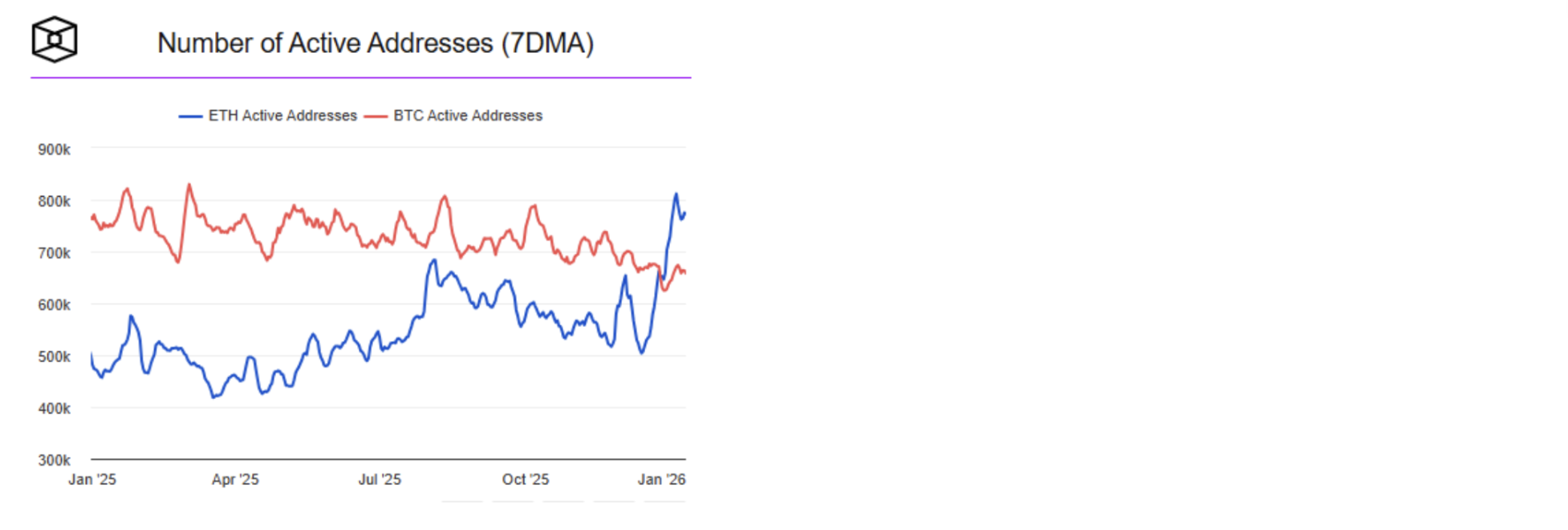

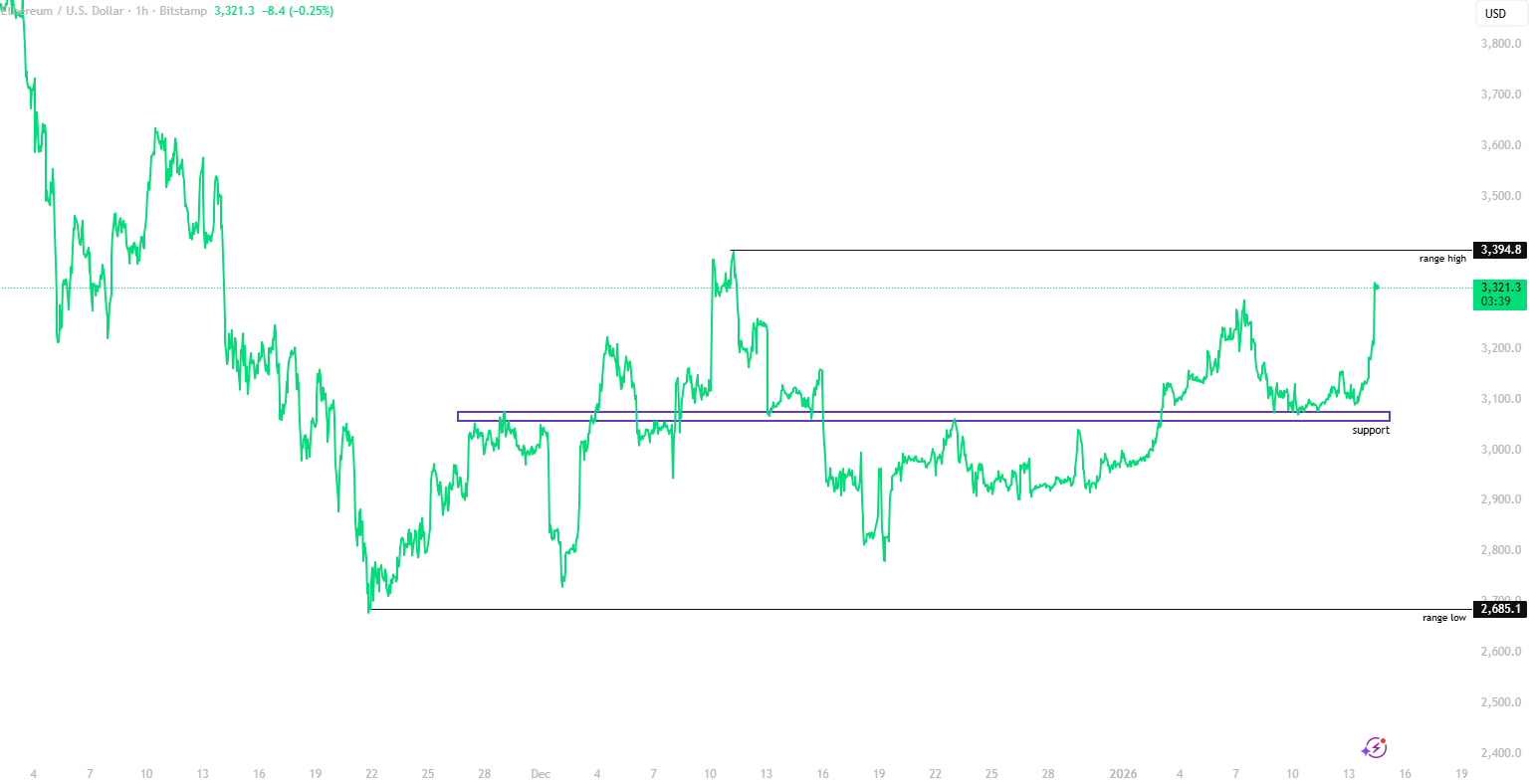

On the charts, ETH active addresses have surged, recently overtaking Bitcoin on a 7-day basis. Price-wise, ETH is holding above a key support zone around the low-US$3k area, looking to break out above the range at $3400 USD.

XRP

Time to check in on everybody's Dads favourite coin.\ \ XRP’s taking a breather after last week’s sharp run-up.

On the news side, Ripple received approval from the UK’s FCA to expand its crypto payments services, a green light that allows Ripple to scale regulated payment infrastructure across the UK. It’s another step forward for XRP’s use case in cross-border payments, particularly in regulated markets.

On the chart, XRP has been pulling back after a strong rally where the RSI flashed overbought signals on most of the timeframes, retracing toward what traders call the “golden pocket” a Fibonacci zone (roughly the 61.8% retracement) where price often pauses or stabilises after fast moves.

In simple terms: it’s a common area where markets catch their breath.

For now, XRP is consolidating, resetting after momentum.

POLYGON

Polygon has been one of the standout movers, up 24% over the past week. Polygon (previously Matic) was one of the first Layer 2 scaling solutions for Ethereum, quickly becoming a popular choice for faster, cheaper transactions during the previous cycle.

The strength comes as attention returns to Polygon’s push into payments and real-world use cases, particularly around its Open Money Stack infrastructure designed to support stablecoins, onchain settlement, and enterprise payments.\ \ Recent reports also point to rising onchain activity and increased token burns, suggesting usage is picking up alongside the price move.

GOLD (PAXG)

Gold is still exploding with PAXG up % this week hitting all time highs again.

Lets dive into a GOLD VS BTC chart comparison.

Zoom in (2025/26):

As this Gold vs BTC chart presents, Since 2025, PAXG has outperformed Bitcoin, reflecting gold’s recent strength as capital rotated toward traditional safe-haven assets. That same rotation has helped push silver and platinum to fresh all-time highs, a typical feature of heating commodity cycles.

Zoom out:

Now pull the same chart way back. Against Bitcoin, gold is down over 99% vs BTC.\ The line on the chart looks pretty flat there until you zoom right in.

TL;DR:

PAXG is gold on-chain. Short term we are seeing a commodity cycle. Lets see where this will take us.