The Weekly Wrap

Well… that escalated quickly.

A market-wide selloff over the weekend knocked crypto down 10.91%, wiping out roughly $308.85 billion in a matter of hours. And as the liquidation heat map shows (below), there wasn’t much buy-side liquidity waiting below, so once the selling started, the dip just… kept dipping.

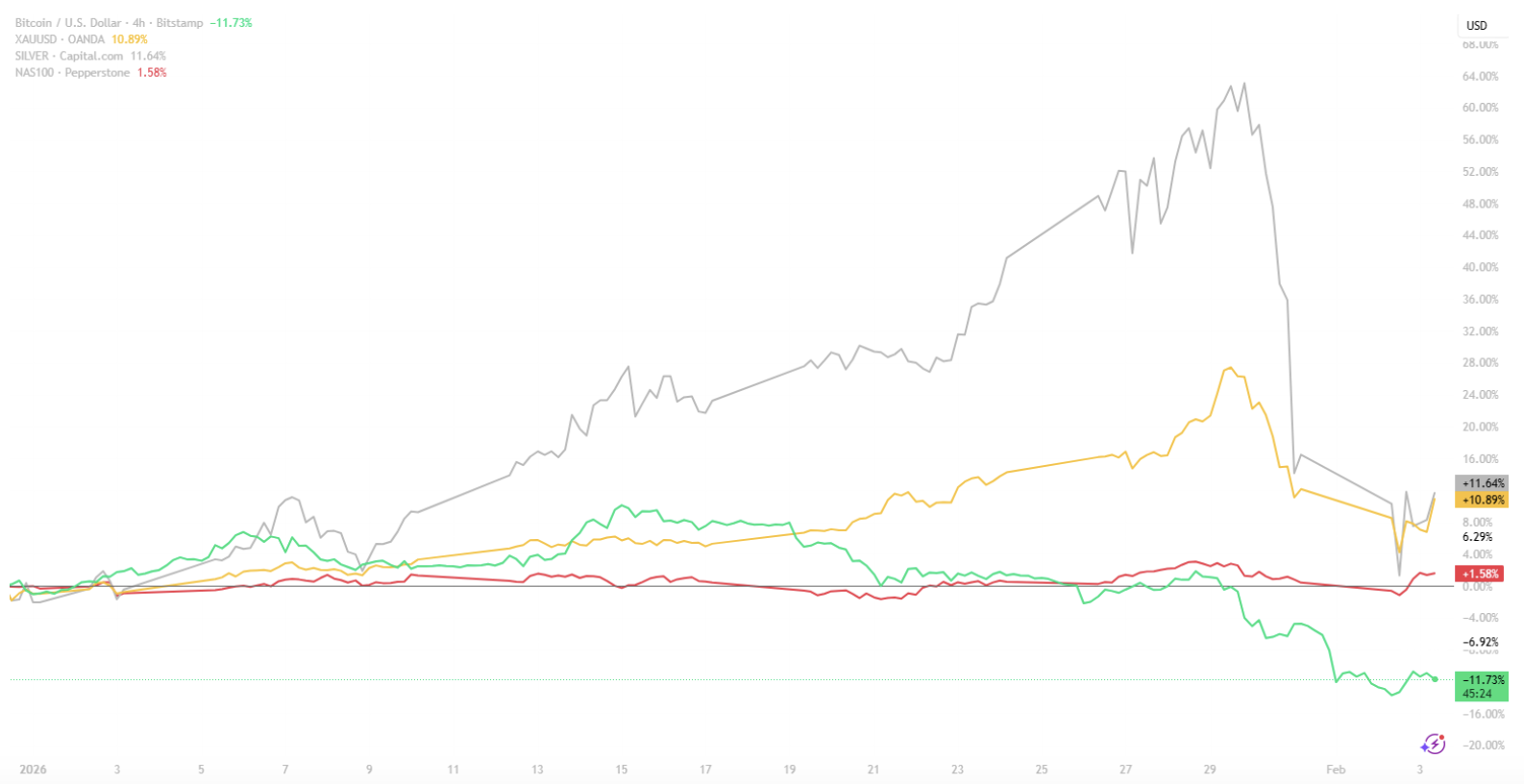

But crypto wasn’t alone, Gold had its worst day since the 1980s, dropping 12% and erasing around $3 trillion in market value. For context: that’s more than the entire crypto market disappearing in a single move. Silver fared even worse, plunging 30%, its sharpest collapse since the Hunt brothers saga.

Risk-off was everywhere. Unsurprisingly, sentiment followed price. The Fear & Greed Index has slid back into “extreme fear,” now sitting at 15. Panic, forced liquidations, and thin liquidity did the rest.

A quiet but bullish macro signal: the ISM PMI is back above 50 for the second time since 2022, a level that’s typically friendly for risk assets like equities and crypto.

Over the last 7 days:

- Bitcoin (BTC) down14.83%

- Ethereum (ETH) down 25.04%

- XRP down 16.81%

- Solana (SOL) down 21.87%

Other movers:

BTC

Bitcoin had a rough week. A 14.83% drop during the market-wide flush wiped $425B off total crypto market cap in just seven days. Not exactly the “number go up” week anyone ordered.

That $82k range low we’ve been talking about for the past month? Yeah… it didn’t hold. Price sliced straight through it and is now trying to find its footing between $75k–$79k, where buyers have finally started to show up.

ETF flows didn’t help. $1.346B in outflows hit on Thursday and Friday alone, setting the tone before the weekend sell-off even kicked in.

Zooming out, this zone is must-hold territory for BTC. If support sticks, the structure starts to resemble a potential double bottom, similar to setups seen in stocks like Google and NVIDIA before their rallies. If it fails? The next obvious liquidity magnet sits down at the 2021 highs around $69k.

ETH

Ethereum didn’t escape the carnage. ETH slid 25.04% over the past week, dragging the price all the way back to the $2,300 USD zone.

That level matters. It’s acted as key support since late 2023, with only a brief breakdown before ETH went on to rally toward its 2025 highs last September. Bulls will be hoping for a similar script this time around because if this level doesn’t hold, the conversation around fresh all-time highs may be on ice for a while.

On the momentum side, things are stretched. The daily RSI has dropped into extremely oversold territory. The last time ETH looked this washed out, it went on a run from $1,500 to $4,800 in mid-2025.

And while price has been ugly, usage hasn’t blinked. January 2026 recorded the highest number of transactions ever on the Ethereum network, a reminder that people are still building, transacting, and using ETH, even when the chart looks scary.

Price is hurting. Fundamentals are still very much alive.

ALTCOINS

Meme Coins

Many wow. And many ouch.

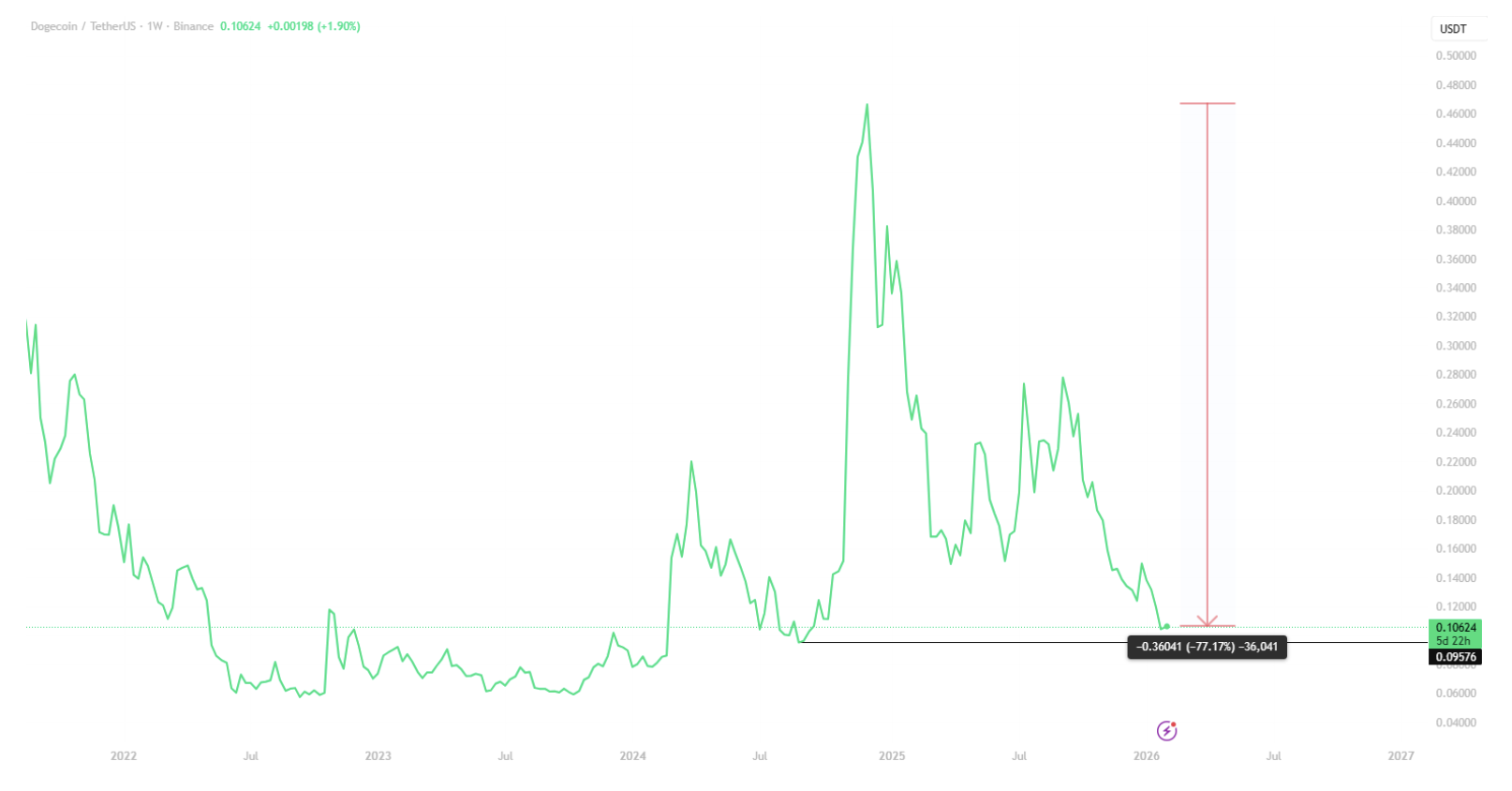

It’s been a while since we checked in on meme coins, mostly because they’ve been in a steady downtrend since late 2024. Dogecoin is now 77.17% off its highs, quietly reminding everyone that memes giveth… and memes taketh away.

It hasn’t been any kinder elsewhere. PEPE is down 84% over the same period. BONK, after ripping more than 400%, was promptly sent back to reality with an 86.20% drawdown.

The biggest casualty? The Trump token, which is now 94.31% lower than the chaos-filled highs around its listing.

Meme coins thrive in attention-driven markets, where liquidity is abundant and risk appetite is high. Without momentum from the majors pulling capital into crypto, memes have struggled to find oxygen, proving once again that when the music stops, they’re usually the first to notice.

Learn how to protect yourself from Cointrees fake token scam guide

GOLD

Gold just punched through $5,000/oz USD, and the flows tell an interesting story. Tether reported that its gold-backed token Tether Gold (XAUT) is now growing faster than USDT, with supply up 38% in Q4 versus USDT’s 7% growth. That translated to roughly $882M USD in tokenized gold sold in one quarter alone.

The takeaway? As inflation and debt concerns linger, demand isn’t just moving into dollars on-chain, it’s rotating into tokenized gold, blending a centuries-old store of value with crypto rails.

The commodities supercycle is still doing its thing. Since the start of 2026, silver is up 55.9%, platinum 30.7%, and gold 19.8%, all comfortably outperforming crypto. Over the same period, the total crypto market cap is up just 0.7%, highlighting how capital has been rotating into hard assets while digital assets consolidate.

BUY PAXG (GOLD)