The Weekly WrapCrypto finally hit the brakes.

After weeks of heavy selling, the market-wide sell-off paused, with total crypto market cap finding a low near $2.05T (down 21%) before rebounding to $2.35T. Even with the bounce, the market still closed the week down 10% compared to last Wednesday.

Sentiment hasn’t improved much. Fear remains firmly in “extreme fear” territory, and bear-market chatter is getting louder by the day.

But under the surface, activity picked up in a big way.

On February 6, spot trading volume hit $930 billion in a single 24-hour period, the highest level since November last year. That kind of volume usually shows up when emotions are running hot, not when markets are calm.

ETFs told a mixed story too. Bitcoin ETFs recorded $318M in outflows, while Ethereum saw $165M leave. XRP bucked the trend with $6.31M in inflows, while Solana saw $8.92M in outflows. DOGE also has an ETF that launched in late November 2025 and that saw 252k inflows the previous week.

Now, attention turns to macro.

After last week’s bullish ISM PMI print, all eyes are on U.S. CPI this Friday. The Fed’s last inflation reading came in at 2.7%. A softer print would increase expectations for future rate cuts. Historically, crypto has reacted well when that narrative gains traction.

There’s also a high-stakes White House meeting on February 10, where the CLARITY Act could shape the future of stablecoins in the U.S.

Volatility may have paused, but the week ahead looks anything but quiet.

Over the last 7 days:

- Bitcoin (BTC) down 10.31%

- Ethereum (ETH) down 11.84%

- XRP down 13.08%

- Solana (SOL) down 17.54%

Other movers:

BTC

Bitcoin had a volatile week. Price fell 12.65%, briefly dipping to around US$60k before bouncing back toward US$70k, where it’s now attempting to consolidate as the market catches its breath. Unsurprisingly, sentiment took a hit, with fear levels spiking as the move played out.

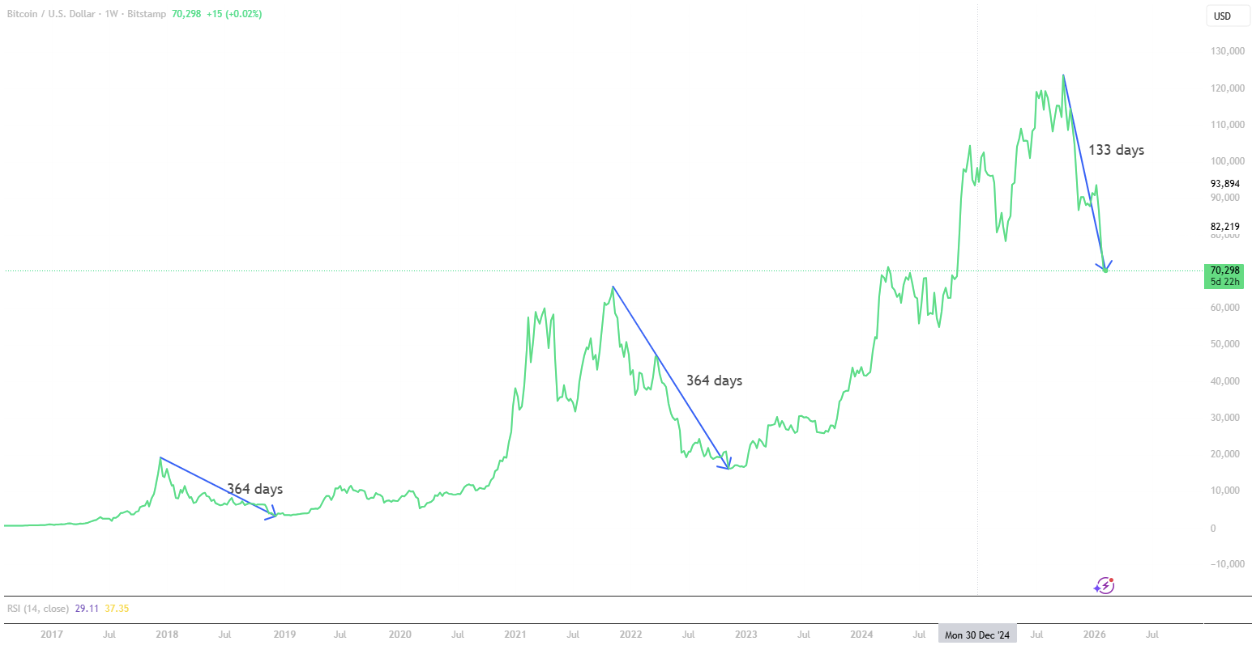

From the 2025 highs, Bitcoin is now down more than 50%. That sounds dramatic, but it’s not unprecedented. During the 2021 cycle, BTC experienced a drawdown of roughly 75%, while the 2017 cycle saw declines of around 83% in the year that followed. Volatility has always been part of Bitcoin’s market structure.

Whether this marks the start of a full bear market is still unclear. This cycle has introduced new dynamics, particularly ETF-driven institutional flows, which previously led some to question whether a 50% drawdown would even occur. History suggests cycles tend to rhyme, but they rarely repeat perfectly.

Looking at the longer-term chart, prior cycles show a similar rhythm, with the move from cycle peak to subsequent cycle low taking roughly 12 months in both cases. Bitcoin has now retraced back toward the 2021 highs and has begun consolidating around that zone, an area many market participants are watching closely as the next phase unfolds.

After a bullish ISM PMI print last week, the focus shifts to Friday’s CPI report, with macro data and liquidity conditions still driving market moves.

ETH

Ethereum briefly fell below 2000 USD on Friday before a slight recovery seeing us move back above 2100 USD at the time of writing. A week after we saw ETH have its best month on record with most transactions on the network, most active addresses with all time low fees the price is yet to follow the activity.

Despite sitting on roughly AUD 10.6 billion in unrealised losses, BitMine Immersion Technologies has continued accumulating Ethereum, adding more ETH last week and now holding around 4.33 million ETH, representing over 3.5% of the circulating supply.

Zooming out on the ETH chart we can see a range low of 1400USD that we would like to hold to show support. There is a long term resistance level that we will need to break at around 2400 USD that we will need to break if we want to see some bullish momentum from ETH.

ALTCOINS

XRP

XRP quietly did its own thing last week.

While most major coins saw ETF outflows, XRP pulled in $6.31M, bucking the broader trend. That relative strength stood out during a week where risk appetite was clearly thin.

On the chart, XRP has now filled the wick from the market-wide crash that saw price briefly drop nearly 50% in an hour, sliding from $2.67 to $1.25. After dipping back below that level and bouncing, the market is now watching closely to see whether buyers can hold this zone or if volatility makes another appearance.

Fundamentally, the narrative hasn’t changed. Ripple reiterated its long-term commitment to the ecosystem, outlining an institutional DeFi blueprint for XRPL built around compliance-focused infrastructure, with XRP positioned as a settlement and bridge asset.

All eyes now turn to the upcoming CLARITY Act meeting, which could finally define the line between securities and payment tokens, a distinction XRP has been fighting for for years. The outcome may also shape how Ripple’s RLUSD stablecoin is used going forward, either as an institutional, yield-bearing product or a pure settlement tool.

Quiet week on price.\ Busy week on positioning.

SKY

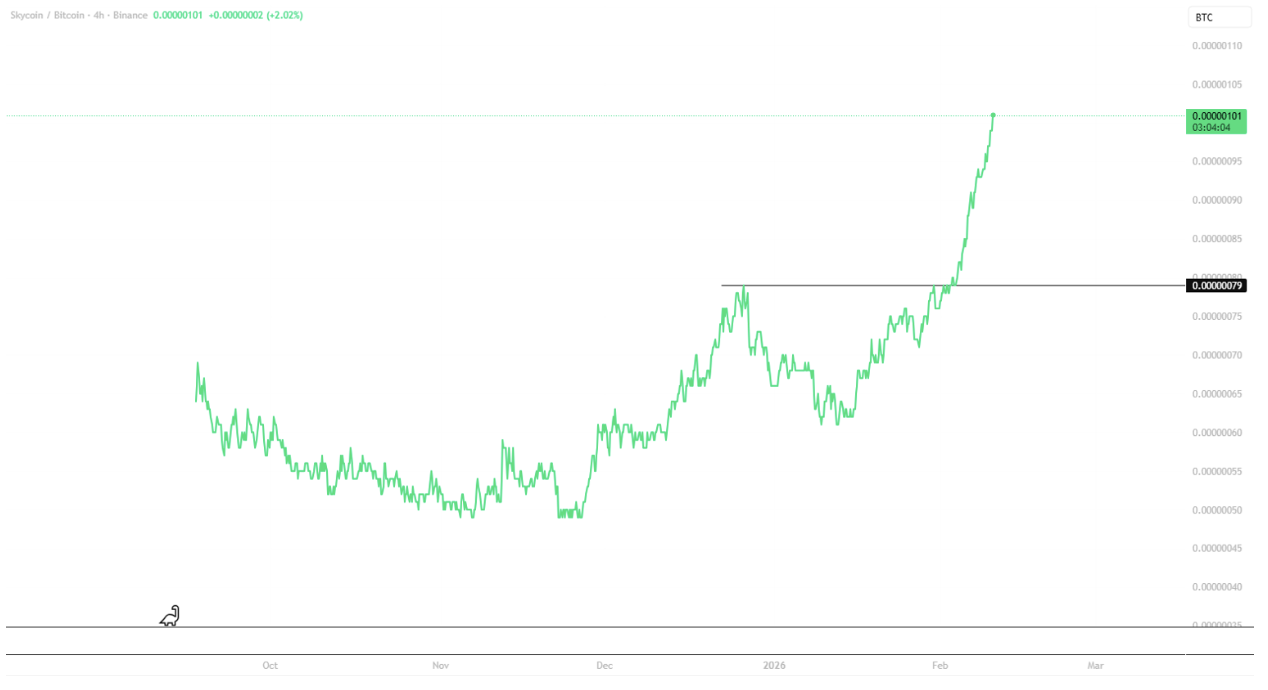

Sky has rocketed 11.45% this week.

Sky Protocol just completed a $1.9 million buyback, acquiring 31 million SKY tokens last week. This latest buyback brings the total cumulative amount spent on buybacks to over $108 million. The move is part of Sky Protocol's ongoing strategy to manage its token supply and support market stability.

Since the SKY rebrand (previously MKR) Sky has been one of the top performers in crypto. As you can see in the chart it has steadily outperformed BTC since NOV last year and now a recent breakout from the trend seeing a big surge this week compared to the rest of the market.

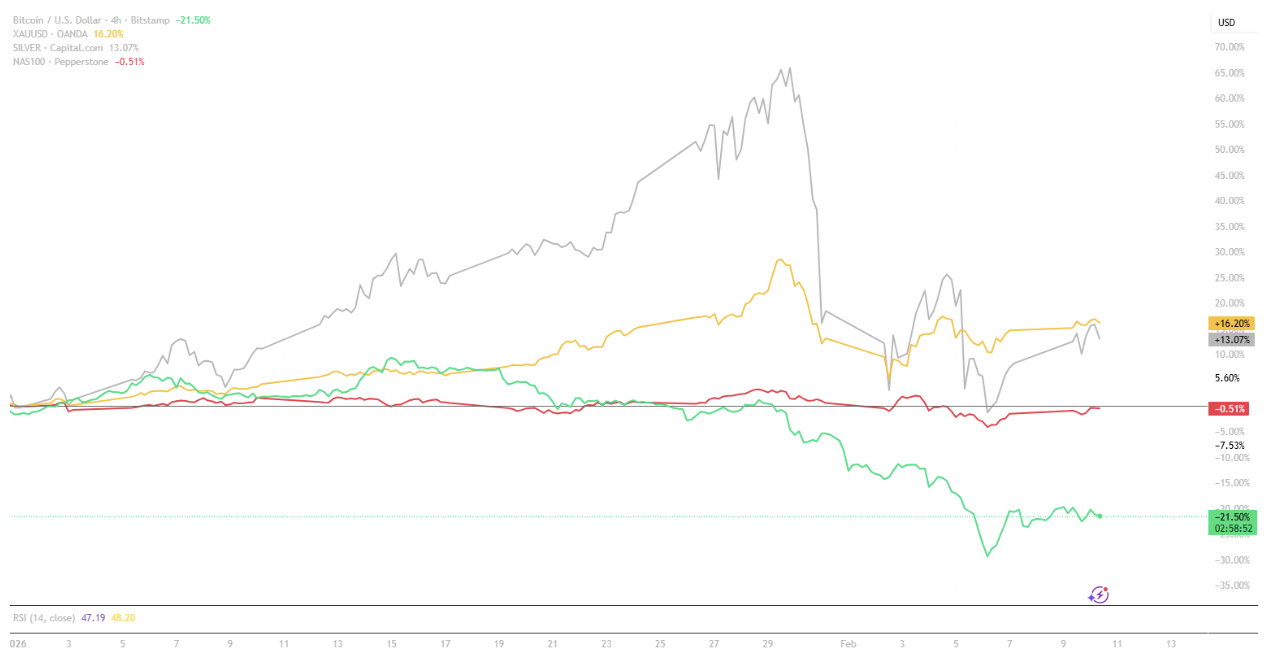

GOLD

Gold has staged a solid bounce after the recent US$3 trillion wipe-out, reclaiming roughly 11% from the lows and now consolidating around the midpoint of its recent range, still about 11% below all-time highs. The 50% retracement is often a key level the market watches to gauge whether momentum can rebuild toward prior highs or if consolidation continues.

Behind the scenes, institutional demand remains notable. Tether has quietly become one of the world’s largest non-sovereign gold holders, with Jefferies estimating its reserves at around 148 tonnes worth roughly AUD $32.5 billion, putting the firm’s bullion holdings in line with several mid-sized nation states.

Zooming out, precious metals continue to lead in 2026. Gold is up 16.20% YTD, silver is close behind at 13.07%, while the NASDAQ-100 is largely flat, down 0.51%. By comparison, Bitcoin remains under pressure, down 21.50% on the year, highlighting the ongoing performance gap between commodities and risk assets over the past 8 months.

For 2026, the scoreboard still belongs to hard assets and the market is watching closely to see whether that leadership holds.

BUY PAXG (GOLD)